Quinbrook Triumphs with $3 Billion Raised for Net Zero Power Fund

- Hammaad Saghir

- Aug 3, 2024

- 2 min read

Specialist global investment manager Quinbrook Infrastructure Partners has closed its fifth consecutive energy transition-focused fund, securing $3 billion for the Net Zero Power Fund (NZPF). This milestone marks a significant advancement in clean energy infrastructure investments to propel the global energy transition.

Yesterday, Quinbrook confirmed the final close of the NZPF, highlighting its success in attracting a diverse group of new institutional investors. These investors hail from various regions, including the US, Canada, Australia, the UK, Sweden, Norway, Finland, and the EU. The mix includes pension funds, sovereign wealth funds, insurance funds, endowments, and family offices.

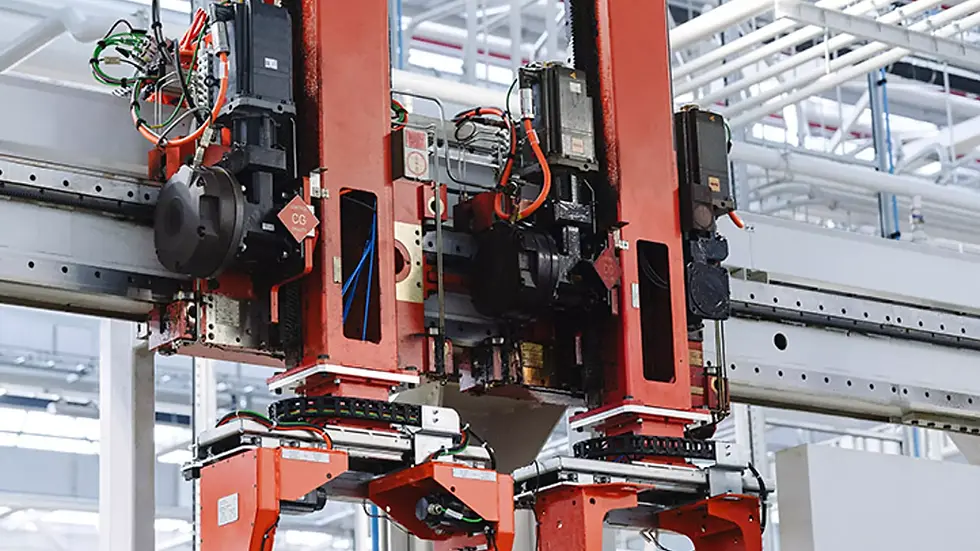

Quinbrook's NZPF investment strategy is meticulously designed around several key themes. These include large-scale solar and storage projects, sustainable infrastructure solutions for hyperscale data centers, renewable fuels production, synchronous condensers providing direct grid support, and strategically located contracted battery storage. This comprehensive approach underscores Quinbrook's commitment to supporting and accelerating the energy transition on a global scale.

"This successful closing - Quinbrook's largest to date - is a demonstration of the confidence our investors have in our differentiated investment strategies around project development, asset creation, and business platform growth coupled with active asset management," said David Scaysbrook, Quinbrook's co-founder and managing partner.

"We seek higher' value-add' returns from infrastructure opportunities offered by the energy transition, which enable us to secure long-term contracted revenues from top-tier customers."

Notable investments in Quinbrook's portfolio include Primergy Solar, a US-based developer, owner, and operator of solar and storage projects. Primergy Solar boasts a development pipeline exceeding 12GW across multiple US states and power markets, with long-term customers such as AWS and Microsoft.

Quinbrook has also invested in the UK portfolio Project Severn, which comprises two synchronous condensers in Sellindge, Kent, and Cilfynydd, South Wales. These projects, currently in early-stage construction, are expected to provide critical grid stability once operational. Quinbrook secured contracts for both projects during Phase III of the National Grid's Stability Pathfinder Program.

"The Net Zero Power Fund follows our successful Low Carbon Power Fund and Renewables Impact Fund, which enabled us to develop, build, and operate some of the largest and award-winning renewable energy, battery storage, and grid support projects in the US, UK, and Australia," said Rory Quinlan, Quinbrook's co-founder and managing partner.

"We are grateful for the support we've received from our existing investors and welcome many new investors to Quinbrook from all over the world. This latest closing is a testament to our exceptional team who have worked tirelessly to execute and deliver real results for our LPs from differentiated and impactful offerings driving the energy transition forward."

Quinbrook reported that it has already invested and committed more than half of the total committed capital across its existing portfolio to date. The firm anticipates being fully engaged within the next 12 months.

The NZPF is the third fund Quinbrook has closed in the past year, representing more than $4.3 billion in aggregate commitments. This impressive total includes $600 million for the Quinbrook Valley of Fire Fund, which held its final close in April 2024, and £620 million for the Quinbrook Renewables Impact Fund, which closed in October 2023.

![LOGOTYPE [GREEN_DARK GREEN].png](https://static.wixstatic.com/media/d6e0b6_7c15be730f2c42d4ad22da5f1e69fa35~mv2.png/v1/fill/w_877,h_198,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/LOGOTYPE%20%5BGREEN_DARK%20GREEN%5D.png)

.png)

Comentarios